Cryptopronetwork.com : Crypto Trends & Market Analysis

In the ever-evolving landscape of cryptocurrency, understanding market trends and investing strategies is crucial for both seasoned and novice investors. Cryptopronetwork.com emerges as a pivotal resource, offering in-depth analysis on current market dynamics, emerging technologies, and behavioral influences that drive price movements. With a keen focus on adaptability amid regulatory changes, the platform provides insights that could significantly impact decision-making in this volatile environment. As we explore the implications of these trends, one must consider how future predictions might shape investment approaches in the coming months.

Current Market Trends

What factors are currently shaping the cryptocurrency market?

Market volatility remains a significant influence, as rapid price fluctuations can impact investor sentiment and decision-making.

Additionally, trading volume has surged, reflecting increased interest and participation from both retail and institutional investors.

These dynamics create a landscape where agility and informed strategies are paramount for navigating the complexities inherent in cryptocurrency investments.

Emerging Technologies

As market volatility and increased trading activity redefine investor engagement in cryptocurrency, emerging technologies are poised to further transform the landscape.

Innovations in blockchain scalability enhance transaction speeds and reduce costs, fostering the growth of decentralized finance (DeFi) platforms.

These advancements not only improve accessibility but also empower users, aligning with the broader desire for financial autonomy in an increasingly digital economy.

Investment Strategies

Investment strategies in the cryptocurrency market must adapt to its inherent volatility and rapid technological advancements.

Investors often weigh long term investments against short term trading approaches. Long-term strategies focus on holding assets to capitalize on overall market growth, while short-term trading seeks to exploit price fluctuations for immediate gains.

Balancing these strategies is crucial for maximizing returns and mitigating risks in this dynamic landscape.

Analyzing Market Movements

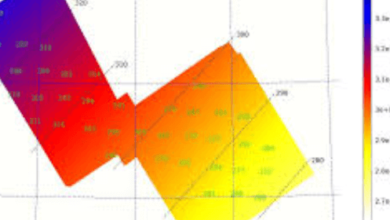

How do various factors influence market movements in the cryptocurrency sector?

Analyzing market psychology reveals how trader sentiment and behavioral biases affect price fluctuations.

Additionally, technical analysis tools, such as moving averages and support levels, provide insights into potential trends.

Future Predictions

Numerous factors are poised to shape the future of the cryptocurrency market, making predictions challenging yet essential for investors.

Long-term forecasts indicate that market volatility will persist, influenced by regulatory developments, technological advancements, and macroeconomic trends.

As investors navigate this unpredictable landscape, a keen understanding of these dynamics will be crucial in capitalizing on opportunities while mitigating risks inherent in the evolving crypto ecosystem.

Read Also: AvStarNews.com Updates : Breaking Stories & Headlines

Conclusion

In conclusion, the cryptocurrency landscape remains a dynamic arena, characterized by significant volatility and rapid technological advancements. Investment strategies must adapt to these changes, leveraging behavioral psychology and technical indicators to enhance decision-making. As regulatory frameworks evolve, the importance of flexibility in approach will become paramount. Future predictions suggest that those who can navigate this complex environment—much like a skilled mariner charting a course through turbulent waters—will find opportunities for growth and success in the digital currency realm.